Content

When startup bookkeepingers purchase services discussed on our site, we often earn affiliate commissions that support our work. Early setup involves creating an account and answering questions like when your fiscal year starts and what type of business you have. The last three years must have been brutal for you if you own a small business. You survived the worst of the COVID-19 pandemic, only to be slammed with crippling supply chain issues. You’ve had to focus more than ever on money in and money out. FreshBooks integrates with lots of apps you already use (and some new ones you’ll be glad you found) to make running your business a breeze. Now you are able to know for certain that your books are up-to-date and make informed financial decisions about your startup.

Its clean, intuitive dashboard provides startups with a central location to see income and expense quickly and easily. Like other top applications, Xero works well with other third-party solutions.

Choosing an Accounting Software for Your Startup Business

But properly tracking your financial transactions is part of being a business owner, whether you’re a startup or an established business owner. Remember, time is money and do you really want to be spending your hours scrabbling through receipts, bank statements and invoices?

Thanks to its 800+ integrations, https://www.bookstime.com/ tracking, payroll, and many other features can be set up quickly and easily. Time is money for any business, and one of FreshBooks’ most impressive features is the easy-to-use Time Tracker. Startups working project-based jobs can easily start the time tracker using either the web portal or the FreshBooks mobile app. Managers can apply tracked time to users or projects to monitor project costs without missing a single billable minute. Trolley, previously Payment Rails, is a global payments platform. It helps users automate payouts to providers and sellers in over 200 countries and regions.

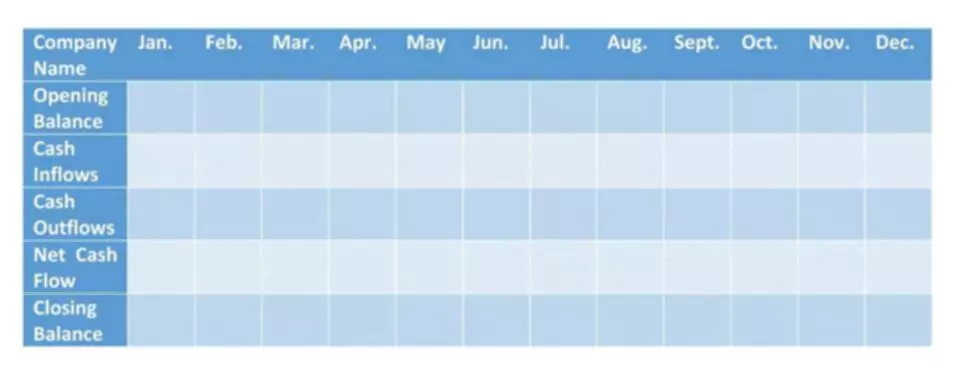

Tasks for Monthly Bookkeeping

FreshBooks creates sleek documents that stand out from the crowd. It’s easy to use and perfect for self-employed entrepreneurs who need an affordable accounting solution. Neat is a good choice for self-employed entrepreneurs who need an easy-to-use accounting software to manage their business finances. NetSuite’s accounting software is a good choice for businesses that need help with financial compliance and those that want to automate as many accounting tasks as possible. This software has a clean interface and also fully integrates with a third-party payroll service. Businesses can collect payment online from customers through Xero’s integration with Stripe and GoCardless.

Can I bookkeep myself as a startup owner?

Potentially. The most important thing to know as a startup owner is that there are many taxes and legal implications to take into consideration. Giersch Group experts can walk you through those.

Zoho Books offers a better mobile app than QuickBooks Online. However, it may be difficult to find support when you eventually convert to an ERP, which will probably be required sooner than with QuickBooks Online. The price of the Ultimate plan is more expensive at $275 per month for 15 users, especially when compared to QuickBooks Online, whose Advanced plan is only $200 per month for 25 users. But its robust mobile app, project accounting, and inventory management features make it a strong contender if these features suit your business’s needs. Xero is a web-based accounting software ideal for small startups in any industry.

Ready to try us out?

For example, do you plan to use specific features such as purchase orders and inventory tracking? You can usually turn tools on or off, which can help you either simplify the user interface or maximize the functions available to you. Accounting software is a computer program that helps businesses track income and expenses. The software can also be used to generate reports, such as profit and loss statements and balance sheets.

Besides businesses, Sage’s software solutions are used widely by financial service firms and global manufacturing companies. Choosing a small business accounting application is challenging. You want the product to allow room for your business to grow, but you don’t want to spend a lot of extra money on features you may never need.

FreshBooks

Understanding where your transactions are coming from is vital to your startup. If you know this metric, you can run geographical ads targeted in that area, have an office closer to your customer base, and more.

Do I Need to Outsource My Accounting? – Business Upside

Do I Need to Outsource My Accounting?.

Posted: Tue, 14 Feb 2023 09:50:17 GMT [source]

Make sure that payments received from your customers are adequately tracked, whether they pay by check, cash, credit card, PayPal, or via ACH transfer. Whenever a customer pays, a record of that payment should be attached to their invoice and filed. If you’re ahead of the curve and using a paperless office, just save a record of the payment to their file. Both bookkeeping and accounting are vital to every business’s success, but you may have an additional need to keep good records as a startup. If you have investors, they’ll require that you provide financial reports. And if you are trying to get a business loan, you’ll need clear and easy-to-read financials so that potential investors can make an informed decision about investing in your vision. Large – Plus unlimited historical data import, extended inventory tracking, product mapping, bundles and assemblies syncs, white-glove onboarding, and unlimited users.

Kubernetes中文社区

Kubernetes中文社区

登录后评论

立即登录 注册